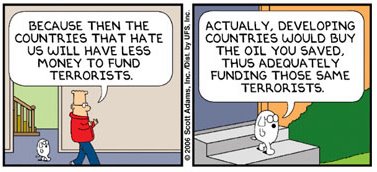

Well, the oil sabers they are

a'rattlin' again as Chavez's Oil Tsar Rafael Ramírez resumes threats to start selling Venezuelan oil to China instead of the US. The threat seems formidable, but only if you studiously avoid thinking through its implications.

Currently, Venezuelan oil travels 3,200 km. to get to the US Gulf Coast. Middle Eastern oil travels 7,000 km. or so to get to China. Overall, oil has to be shipped over some 10,000 km. to satisfy both countries' demand.

What would happen if Venezuela were to go through with its threat?

First off, Venezuelan oil would have to travel over 15,000 km. to get to China. And the US? Well, every barrel of oil China buys from Venezuela instead of the Middle East is a barrel of Middle Eastern oil it frees up for other buyers. The US, facing a sudden shortfall, would presumably buy it. And that Middle Eastern oil would have to travel about 12,000 km. to get to the US.

So demand that might have been satisfied by shipping oil over a total of 10,000 km. will now take 27,000 km. of shipping to satisfy.

(In fact, it's even worse than that: in the short-term, most of the refineries able to handle Venezuela's sour crude are in the US Gulf Coast - so Venezuelan oil would likely end up being shipped to the US, refined, pumped back into a tanker as products and shipped off to China!)

At the end of this whole silly rigmarole, does the US get any less oil than before?

No. Does China get any more oil than before?

No.Is the total amount of oil in the market altered?

No. Is the world price changed?

No. The only difference is that oil travels farther from producer to consumer, raising transportation costs all around. The US and China pay more for their oil imports, Venezuela and the Middle East get less from their oil exports. Only the shippers gain.

Viva la revolución, no joda!